North Asia’s Changing Aviation Face

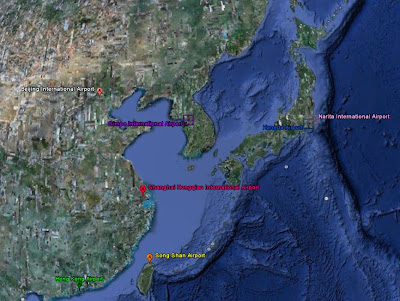

In 1990, just eight city-pairs and 59 frequencies connected Japan and China. Tokyo Narita with its single runway dominated traffic flows in a highly regulated North Asia. Korea’s airlines were in disarray or too small to register. China was yet to deliver on its promise and Northwest Airlines and the 747 ruled the North Pacific routes into Asia through Japan.

Two decades later the landscape is barely recognizable. Each week well over 630 flights connect more than 60 Chinese and Japanese cities. Boeing 777s overfly Japan into Korea and China from the US and NRT has lost much of its standing as the gateway to Asia. China is moving toward the mantle of the world’s single largest aviation market. Korea’s airlines have emerged as powerful competitors focused almost entirely on international services. And a host of US carriers ply the North Pacific on point-to-point routes.

As the pace of change in the region accelerates, the landscape will change significantly again within five years, says Centre for Asia Pacific Aviation Chairman Peter Harbison. “The competitive situation is getting very fluid with some fascinating dynamics at play,” he explains. Those dynamics include the entry of low-cost giant AirAsia into the region, the order by Japan’s tiny Skymark Airlines for four Airbus A380s, the aggressive expansion plans of All Nippon Airways, the troubles at Japan Airlines and the intercontinental ambitions of China’s airlines. This does not take into account any short-term disruptions arising from last month’s sequence of catastrophes in Japan and the unknown impact of radiation fears on traffic patterns that potentially could last for several years.

IATA DG and CEO Giovanni Bisignani put the scale of the potential change in perspective in an address to the Foreign Press Club in Tokyo in late February when he said that almost 50% of the increase in world traffic over the next five years will come from the Asia/Pacific and China markets. “Of the 800 million new passengers who will fly by 2014, 360 million of them will be in Asia/Pacific and 214 million of those in China alone.”

According to IATA data, the region overtook North America as the largest aviation market in 2009. “The difference was small, and both had a 26% market share. But by 2014 Asia will account for 30% of global traffic while North America will fall to 23%,” Bisignani said. And he noted that in aggregate the region’s carriers are the most profitable in the industry, with $7.7 billion earned in 2010 and $4.6 billion forecast for this year. “They are on a firm financial footing and well-positioned to continue to expand with their economies.”

To Be Or Not To Be

However, while the region will prosper as a whole, there will be casualties as states and airlines fail to keep pace with change. Bisignani singled out Japan: “In 2009, with 54 million passengers, it was number seven for international travel, ahead of China at 49 million, but by 2014 we expect it to fall to number nine with 72 million passengers, behind China with 82 million.” The challenge for Japan is that its air transport sector is the most regulated in the region and the rate of change until now has been glacial, risking marginalization.

Japan’s airports are a major part of the problem, Bisignani said, with a “politically driven construction agenda” that put capacity where demand was limited. “That is still an issue, but the Tokyo situation is [finally] changing. It now has two main airports that are competing and adding capacity.” The airports, however, are still about 75% more expensive to fly to than Seoul Incheon and more than double Singapore Changi.

The solution, Bisignani and Harbison argue, is to move away from cross-subsidization, unjustified fees and unnecessary government involvement. “There needs to be true competition between the airports. For Haneda we need a level playing field with common charges for domestic and international operations,” Bisignani said. Currently, international flights are 50%-75% more expensive to operate than domestic flights.

Geoff Tudor, senior analyst for Tokyo-based Japan Aviation Management Research, adds further perspective: “To be a really international hub, Haneda needs more slots, while long-haul foreign carriers have criticized the late-night/early-morning operation requirement as it makes it difficult for them when it comes to connectivity.” But he notes, “The Japanese public love the arrangement—they can do a full day’s work before leaving on a trip late at night and they can arrive back early enough to head for the office or factory for another full day’s work.”

That local support for Haneda is reflected in the load factors, he says. “ANA has been averaging 85%, beating their estimate by five points, while most of JAL’s flights to Asia and China from Haneda are running at 90% and business traffic is high.” Demand comes from downtown Tokyo and the densely populated area west of the city—Kawasaki and Yokohama. Despite the problems with slots and timings, international airlines are committing to HND because of its popularity with higher-yield business travelers.

Notwithstanding this appeal, the airport has a way to go to be truly classified as an international hub, with only 17 destinations served by 18 airlines compared with the 94 international destinations served by 61 carriers from NRT. Prior to the opening of the new runway in October, HND offered regular services to only three international points—Seoul Gimpo, Shanghai Hongqiao and Beijing—with occasional charters to Hong Kong and Taipei. More international slots, a mix of regional and long-haul, are due to be made available over the next 12 months. ANA’s international destinations from HND are Los Angeles, Honolulu, Singapore, Bangkok, Taipei Songshan, Beijing, Hongqiao and Gimpo.

Narita is responding by reaching out to the hostile local communities with the result that the once strong opposition is giving way to a significant improvement in relations, Tudor says. It was able to increase annual takeoff and landing slots to 220,000 from March last year and an agreement is likely on a 300,000-slot total by March 2015, he says. Also on the radar is a slight but significant relaxation of the curfew by an hour at each end to 24:00-05:00. “The airport is also pursuing new business leads, with a study for attracting LCCs underway and plans forming for the construction of a dedicated LCC terminal which could be running by 2013,” he adds.

Changing Of The Guard

While JAL’s financial and commercial rehabilitation appears to be progressing, it is turning its back on establishing an LCC and is but a shadow of its former size, notes Harbison. “JAL is fragile and it is still in the balance with big union issues and it has no LCC plans because of union pressure.” In late November the courts approved a restructuring calling for the retirement or layoff of more than 16,000 staff by March 31, disposal of 103 aircraft and scrapping of 49 loss-making routes.

Also in March the airline ended its historical relationship with the 747 (at one time it was the world’s largest operator of the type) by retiring its final two. It may well transpire that its greatest asset and chance for success is its antitrust-immunized alliance with oneworld partner American Airlines that starts April 1 and will enable joint pricing and revenue sharing on routes between Japan and the US. JAL is considering a similar tie-up with Cathay Pacific.

Tudor observes that a changing of the guard occurred in November with “ANA carrying more passengers than JAL for the first time and in the same month ANA had again for the first time more flights at Narita than JAL.” The latter’s rehabilitation plan set the international network reduction at about 40% and domestic network cuts at 30%.

Contrasting this, ANA’s international capacity (ASKs) for FY2010 was up 11.2% on the prior year and it just announced a major international network expansion. Over the next three years it is planning to increase capacity by 33%, international passenger revenue by 36.3%, domestic passenger revenue by 8.6% and cargo revenue by 16.7%. One of the pillars of this growth is leveraging its participation in Star Alliance, boosting the cities it serves in Asia directly and with alliance partners from 49 to 85, in Europe from 65 to 75 and in the Americas from 125 to 330.

ANA’s plans are certainly ambitious and in a limited way it has embraced the LCC concept through a joint venture with First Eastern Investment Group of Hong Kong. The new airline, with the working name of A&F Aviation, will lease 10 A320s from GECAS for operation from Osaka Kansai International.

While that move is a “toe into known waters,” Skymark’s A380 order is a plunge into icy depths and is as exciting as it is bold, Harbison reckons. “That order is really going to stir things up.” Skymark, which operates low-fare domestic flights with 18 737NGs, says it plans to launch regular international service and fly the A380 between NRT and London from November 2014, Frankfurt a year later and New York or Paris from 2017. And rather than an all-LCC product, the aircraft will be configured with 114 business seats on the upper deck and 280 premium economy seats on the main deck, with fares half those of current levels, according to the airline.

President Shinichi Nishikubo “admits that his plans for Skymark are challenging and he has no other investment partners at the moment and no time for alliances, which he claims weaken the airline’s efficiency,” Tudor comments. In fact, Nishikubo told Tudor that “Skymark is a crazy company; no one but me wants to invest in such a company.” Crazy or not, the order for A380s adds pressure on ANA and others to follow suit and brings another dynamic to the mix. Tudor remarks that “Nishikubo could join an elite band of airline industry outsiders once considered crazy who went on to great things through innovation and taking risks,” among them Richard Branson, Tony Fernandes and Herb Kelleher.

Potential

Even bigger change is taking place in China. In February, CAAC Minister Li Jiaxiang told media in Beijing that the country will invest CNY1.5 trillion ($229 billion) between 2011 and 2015 acquiring 700 more aircraft and building 45 airports. He told China Dailythat by 2015 China will have 220 civilian airports and the fleet of commercial planes will rise to 4,500. Last year there were 267 million air passenger trips in China, up 16% from the previous year.

But Chinese carriers also face significant structural challenges, including a lack of airspace—the civil aviation industry is permitted to use just 20% with the remainder controlled by the military—a shortage of pilots and concerns that safety margins are being eroded by the addition of too many private airlines (ATW, 2/11, p. 40). Domestically they also are threatened by the government’s rapid construction of a nationwide high-speed rail network that already is capturing traffic formerly transported by airlines.

In response, China’s big three plus Hainan Airlines are looking abroad, but they are significantly behind the curve in areas of network development, passenger amenities and customer service and acknowledge that they have a lot of work to do to become more competitive in the international arena against rivals near and far.

Among the former are South Korea’s powerful Korean Air and smaller but equally ambitious Asiana Airlines. Both have world-class customer service products and operate out of what is arguably North Asia’s finest hub airport. They also have well-developed networks into China and the international networks and alliances to flow traffic in and out.

Through ICN and SEL, KE links 17 Chinese cities with 10 in the US while Asiana connects 20 destinations in China to five in the US. Boeing Commercial Airplanes VP-Marketing Randy Tinseth adds perspective to that growth: “In 1990 there was only one weekly flight between Shanghai and Seoul but in 2008 the Korea-China market was 687 weekly flights connecting 52 city-pairs.” They not only are tapping the China market but also reaching into Japan, he says, noting, “In 1990 there were 16 city-pairs with 208 weekly frequencies and by 2007 that had grown to 43 cities with 571 weekly frequencies.” The influence of the two is going to get greater with 16 A380s on order between them, and both are committed to the 787 and A350 as well.

Behind those commitments are solid balance sheets and profits. After a difficult two years, Asiana earned KRW236 billion ($211.3 million) in 2010, a significant turnaround from a net loss of KRW266.3 billion in 2009, as revenue surged 30.5% to a record KRW5.07 trillion. Korean did even better, reporting a 2010 net profit of KRW468.4 billion, reversed from a net loss ofKRW98.9 billion in 2009, although its recovery actually began in the second quarter of 2009. Revenue climbed 22% to KRW11.46 trillion.

In May, KE will take delivery of the first of 10 A380s to be used on US and European routes. Its A380 will be the world’s most spacious, with 94 lie-flat business sleepers on the upper deck with a 74-in. seat pitch and extra-large seat partitions, while economy seats will be set 34 in. apart. Asiana plans to operate its A380s, two of which will arrive in 2014, two in 2015 and two in 2017, to the US and/or Europe.

The forces at play in North Asia are many and varied and it is difficult to forecast scenarios, says Harbison, except that more change is certain. The steady rise of strong competitors in Korea and the potential challenge of China’s carriers will put more pressure on Japan and its airlines. “I am encouraging Japan to think more strategically about its aviation industry, to improve its competitiveness and to turn around from two decades of decline,” Bisignani said in Tokyo.

Success will give Japan a stronger voice in the Asia/Pacific region, the industry’s largest market. Recent events—the US-Japan open skies agreement and the opening of Haneda to intercontinental services plus the extension of Narita’s second runway—“show that Japan is capable of change,” says Bisignani. But Harbison asks, “Will the change continue and will it come too late?”

Source : http://atwonline.com/airports-routes/article/north-asia-s-changing-aviation-face-0401

The face of air travel in Asia will be much changed by the radiation fears, credible or not, as an aftermath to Fukushima ...

ReplyDelete